The Fall of Buckingham Group

The Fall of Buckingham Group

The post The Fall of Buckingham Group appeared first on UK Construction Blog.

After battling it out for survival for nearly a month, Buckingham Group announced today that they would file for administration, with over 400 jobs lost and casting major doubt around projects such as Liverpool FC’s Anfield Road stadium expansion.

August has been a tough month for the construction industry, with the loss of significant players such as Allma Construction and Henry Construction, showcasing a tumultuous period for the sector as a whole. And though the month of August has ended, the crisis in construction sadly appears to be far from over.

What happened at Buckingham Group?

Buckingham Group announced on the 17th of August that all trading had ceased. In the original statement, released on the company’s website, the Group blamed “rapidly escalating contract losses and a sharp reduction in liquidityâ€�. They also said that “the business has been outweighed by deep losses and interim cash deficitsâ€� causing a sharp downturn in profitability.

Their subsequent statement, released on September 4th, confirmed the appointment of administrators and claimed; “The legacy issues faced by the Company and ongoing losses were simply too great to enable to refinance to success in an acceptable timescale.�

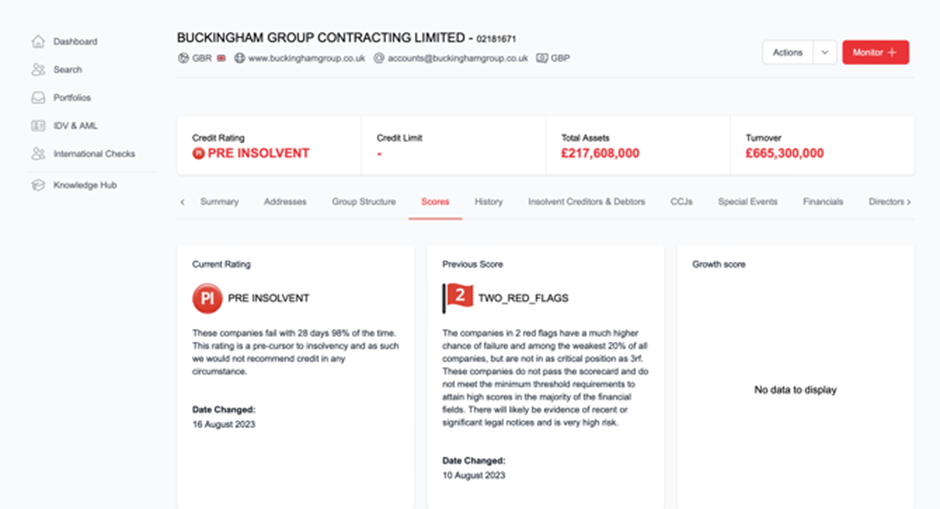

The Group was an industry leader, with a turnover of £655 million in 2021, a figure 99.6% higher than other companies in the construction industry. Originally founded in 1955, they worked on football stadiums across the UK and key infrastructure projects, such as HS2 and multiple other railways. The rail division of Buckingham Group has been picked up by Kier Group, saving 180 jobs, and rescuing projects such as Network Rail’s £78M plans to electrify the railway between Bolton and Wigan.

This tumultuous market proves that having in-built protections through data technology is now an essential safety net for those operating within multiple sectors, but particularly in construction, where over 4,000 businesses have gone insolvent this year alone.

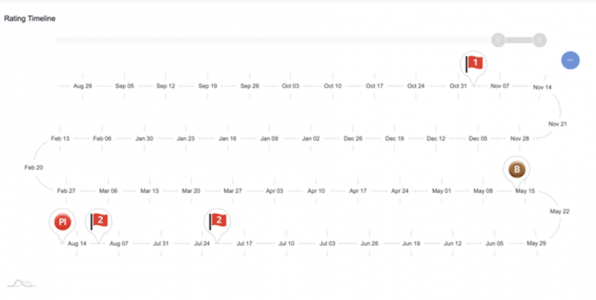

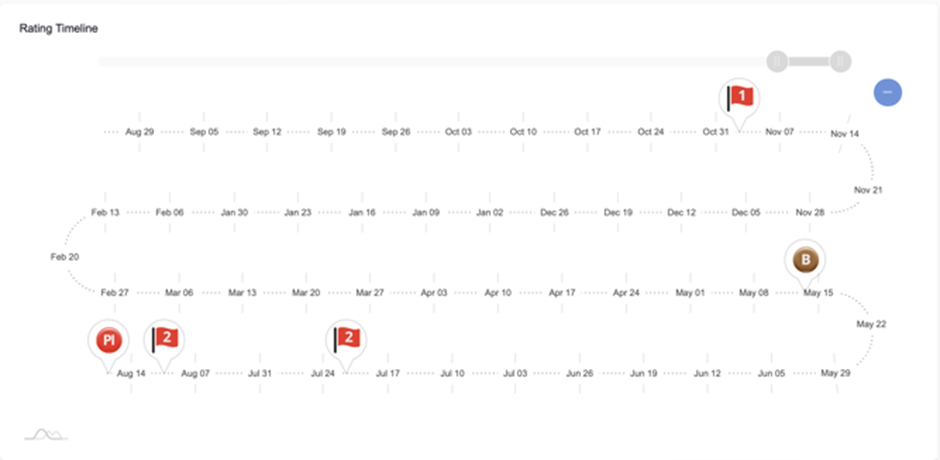

Flagging issues to our users

Did your data provider alert you? Using Red Flag Alert’s proprietary data, we moved Buckingham Group to a ‘One Red Flag’ rating way back in October 2022, letting our users know that they were at high risk of entering financial difficulty. Anyone monitoring Buckingham Group would have received an instant alert and could prepare accordingly. Our algorithm picked up on multiple risk factors, based on the company’s financial history and current performance, and a sharp reduction in liquidity.

At 92% accuracy, our insolvency scoring is the most accurate currently available on the UK market. Many of our competitors didn’t notice the issues at Buckingham Group until much later in 2023, but our users were aware of the failings at the organisation, and that it was identified as high-risk, months before anyone else. Companies that use Red Flag Alert can protect themselves and be aware of exactly who they are doing business with, to avoid unnecessary risk in an unstable environment.  Want to find out more? Download our full report on the Buckingham Group and examine it for yourself.

“It’s been a tough year for everyone in the construction sector,� said Richard West, Managing Director of Red Flag Alert. “We’ve seen a steep rise in the cost of operations and a noticeable impact of bad debt when other companies fail. These economic parallels have caused the perfect storm of insolvencies for those operating within the construction sector. And that’s not good for British industry overall.�

“Here at Red Flag Alert, we try to lessen the impact of bad debt by giving our users vital information at their fingertips and allowing them to set up an unlimited number of companies within our monitoring feature. That way, if anything changes, they’ll be the first to know and can take appropriate action as soon as possible.�

“But let’s be clear – things are getting rocky out there, and businesses need to do everything they can to protect themselves from the impact. They need to monitor customers, suppliers, and partners with software like Red Flag Alert, and they must be aware of the financial history within businesses so they can safeguard their own operations.�

The ongoing issues for construction companies

August alone brought 44 companies into insolvency, a monthly record that no one wants to beat. Although small organisations are most at risk, losses to industry leaders such as Buckingham Group show that no one is immune to the ongoing issues within the sector. A mixture of global and economic factors, coupled with high material costs, labour shortages and cashflow issues, all caused hundreds of thousands of staff to lose their jobs, with more at risk.

Red Flag Alert’s Chief Economist, Dr Nicola Headlam, warned that issues within the construction sector would have a widespread impact that could cause shockwaves in other areas of the economy. She said, “This is not good news for the industry and the UK as a whole. This will lead to a much smaller pool of construction companies available for contracts and for suppliers to do business with.�

“The post-recession economic bounce back will be hampered by a lack of building companies available for projects in the next growth stage and a supply chain that will be unable to respond to growth signals. This will choke off growth in the next economic cycle.�

“One potential upside of this situation is that a lack of companies competing for lucrative building projects could open up greater opportunities for solvent firms, as well as for acquirers within the construction sector. This includes buyers targeting distressed acquisitions, which are likely to be rife should current pressures continue to impact the industry.�

“By supporting construction and funding house building, the government can turn the vicious cycle of insolvency in the industry into a virtuous circle where money flows through the supply chain as opposed to bad debt.”

It’s clear that those in the construction sector need a safety net of data insights to ensure they protect themselves from the shockwaves of insolvency. To find out more about how Red Flag Alert can help you, or to try us out for yourself in a no-obligation trial, sign up for our software today. You’ll receive full access to our platform and all the features, so you can start preventing risk immediately.

Comments are closed