Signs of a building recovery as pipeline begins to stir

Signs of a building recovery as pipeline begins to stir

The first flicker of recovery is beginning to show across the building sector, with consultants and architects pointing to early signs that a market held back by delay and uncertainty may finally be edging forward.

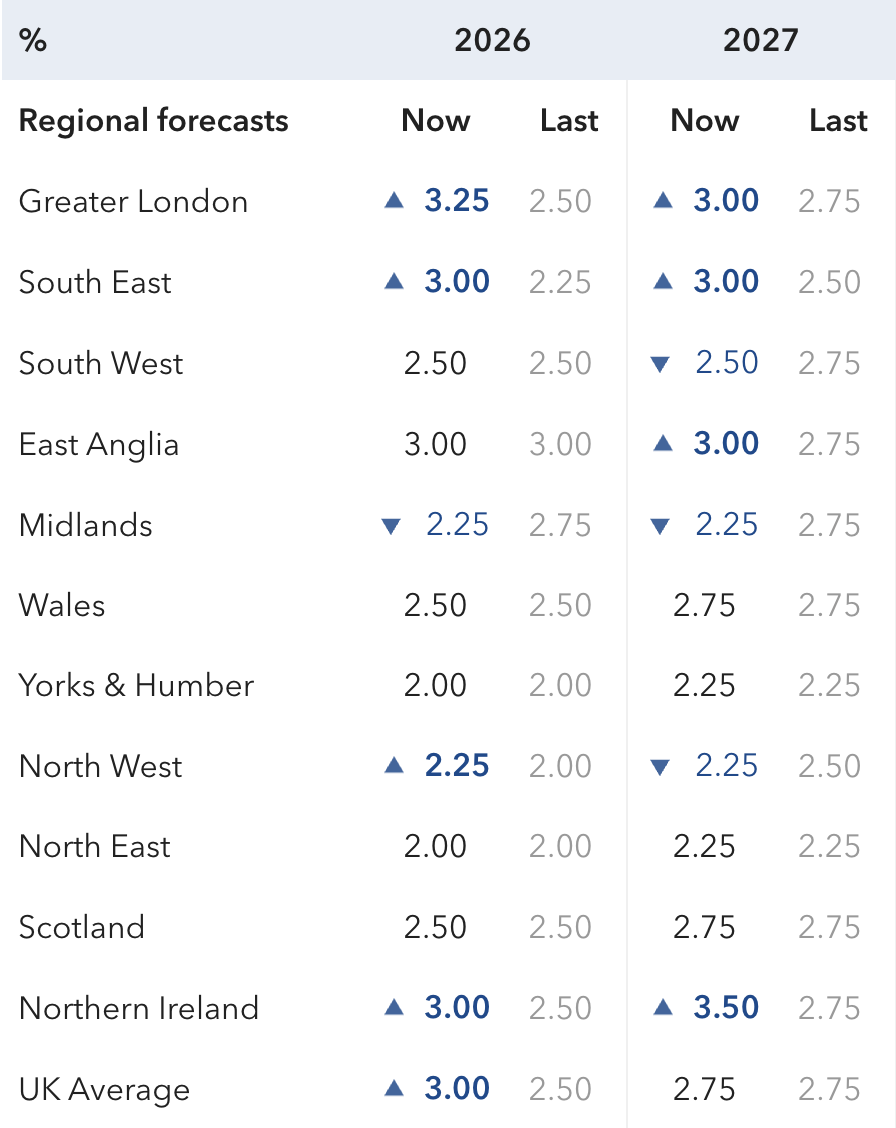

Cost consultant Gardiner & Theobald has revised its 2026 average tender price inflation forecast up to 3.0%, from 2.5%, reflecting persistent cost pressures and a pipeline that is starting to stir rather than stall.

It is not a demand surge driving the upgrade, but a combination of cost resilience and legacy schemes that are moving back into active viability discussions, says the cost consultant.

Contractors surveyed by the cost consultant say projects parked at the end of 2025 are re-emerging, particularly in residential and mixed-use sectors where Building Safety Act Gateway 2 delays had become a critical bottleneck. Approval timelines are shortening and conversations around funding and appraisal are beginning to move again.

The pattern emerging is one of deferral rather than abandonment. Many schemes are being pushed into late 2026 instead of being scrapped outright.

The first half of the year is expected to be dominated by bid progression, feasibility work and funding negotiations, with stronger delivery conditions potentially following in the second half and into 2027.

Fresh data from the Royal Institute of British Architects supports indicators of stirring client demand.

January’s RIBA Future Trends survey recorded a +3 Workload Index, ending four consecutive months of negative balances and signalling tentative optimism at the front end of the pipeline.

Adrian Malleson, head of economic research and analysis at the Royal Institute of British Architects, said: “Our Workload Index suggests confidence is tentatively returning as 2026 begins.”

“While smaller practices remain cautious, medium and large practices continue to report optimism about future work. Sector outlooks remain marginally negative overall, but have improved this month, particularly in private housing.

“Although market challenges persist – including planning delays, regulatory pressures and intense fee competition – some practices report early signs of market recovery and anticipate workloads strengthening in the months ahead.”

Financing conditions remain tight, but with the Bank of England signalling further rate cuts through 2026, the cost of capital is easing at the margins. That shift is helping stabilise sentiment after two years of acute uncertainty.

Market conditions, however, remain uneven. Private building sectors continue to experience competitive tension and margin pressure, with viability — not capacity — the key constraint. There is little evidence of demand-led inflation.

By contrast, public and regulated infrastructure markets are providing firmer workload visibility, according to G+T’s latest survey of contractors.

Water, energy and utilities programmes midway through funding cycles are sustaining activity, particularly in specialist trades where capacity remains constrained. Tier 1 contractors are generally well utilised and maintaining pricing discipline, while Tier 2 firms face more variable conditions in viability-sensitive sectors.

Specialist markets such as MEP remain firm, supported by limited supply capacity and sustained demand from data centres and regulated infrastructure projects.

G+T’s report said: “Importantly, there is little evidence of widespread price-cutting, with risk management and margin protection continuing to shape bid behaviour.”

Comments are closed