OCU’s buying spree drives revenue to nearly £900m

OCU’s buying spree drives revenue to nearly £900m

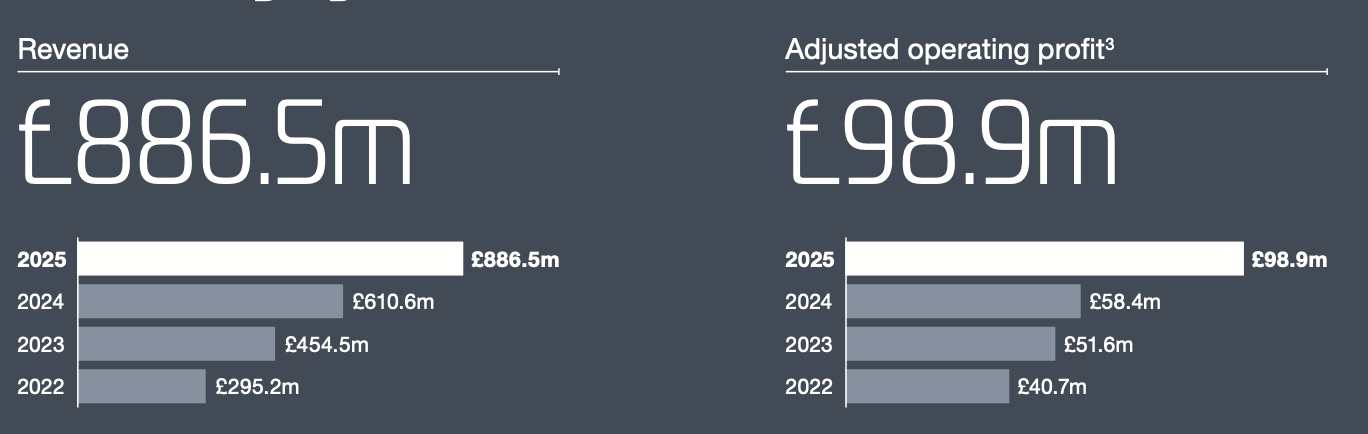

Energy and utilities infrastructure services contractor OCU Group revved revenue up 45% to £887m for the year to April 2025 after bedding in three more acquisitions.

The rapid growth of the private equity-backed group saw it booked a £64m pre-tax loss, double last year’s £31m.

Red ink was driven by higher interest on £656m of borrowings, a jump in non-cash goodwill amortisation from acquisitions, and one-off refinancing costs.

Under the bonnet, trading was strong as adjusted operating profit jumped 69% to £99m with operating margins up to 11.2% from 9.6%. Statutory operating profit after exceptionals was £28.1m.

Top-line growth blended 11% organic progress with a revenue flows from recently bought civils contractor RJ McLeod, water industry design specialist Purestream and trenchless technology expert McCormack Drilling.

These firms added scale across energy, water and trenchless delivery, while a post-year end majority stake in Australia/NZ player AEC opened an foothold further afield in the asia pacific region.

Chief executive Michael Hughes said: “OCU Group has created a robust capability for sourcing, executing, and integrating strategic acquisitions.”

“We maintain rigorous standards, engaging only with companies that meet our high criteria for cultural alignment and commercial rigour, completing around one in every twelve potential transactions.”

Hughes added: “The long-term structural drivers in the UK’s energy transition, digital connectivity, and regulated utilities markets remain clear and compelling.

“Ofgem’s RIIO-ED2, Ofwat’s AMP8, Project Gigabit, and Scotland’s ScotWind program each represent multi-billion-pound investment frameworks aligned to OCU’s capabilities.

“The scale and duration of these programs provide a resilient platform for growth, even in the face of broader macroeconomic volatility.”

Comments are closed