M Group muscles into top five contractors after growth spurt

M Group muscles into top five contractors after growth spurt

Private equity-owned infrastructure services specialist M Group has blasted its way into the industry’s top five contractors after raising revenue 14% to £2.5bn.

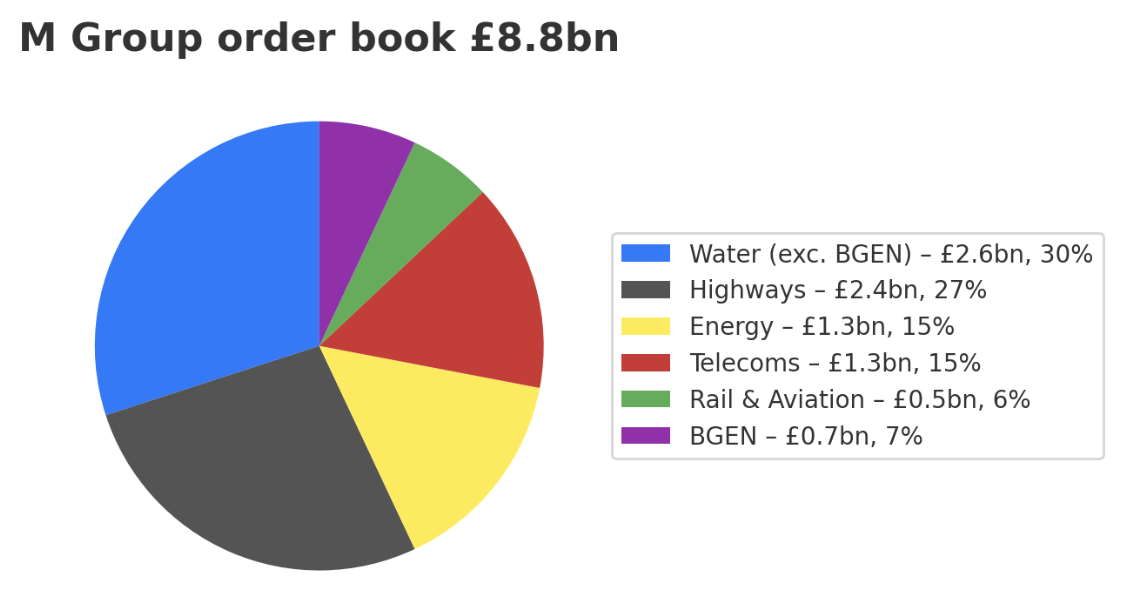

Fresh accounts for the parent company show the CVC-backed infrastructure services giant stacked up an £8.8bn order book (2024: £6.4bn) on the back of booming workloads in its targetted regulated utilities and critical national infrastructure sectors.

Water and energy were the standout performers in the year to March 2025, with water revenues surging 24% to £713m and energy climbing 18% to £551m as utilities ramped up spending on resilience, MEICA upgrades, decarbonisation work and transmission infrastructure.

Telecoms and transport also posted solid gains as fibre rollout, 5G upgrades and highways maintenance programmes continued at pace.

Despite the strong trading picture, M Group remained loss-making on paper due to the impact of private-equity financing and large non-cash accounting charges.

The group posted EBITDA before exceptional items of £131m, up from £117m, but the bottom line was dragged into the red by £114m of amortisation on acquired intangibles and £92m of net finance costs.

That left M Group with a pre-tax loss of £88m, broadly unchanged on last year’s £80m loss, despite significantly higher revenue and gross profit.

Directors stressed that the loss reflects the group’s accounting structure rather than its cash performance, pointing to £191m of operating cash inflow and over £320m in available liquidity.

With major acquisitions in MEICA engineering and home decarbonisation completed during the year — and digital infrastructure specialist Telent signed subject to approval — M Group will enter FY26 as one of the most broadly positioned infrastructure contractors in the UK.

Its shift to a unified M Group brand from April is designed to underline that scale, cutting across water, power, telecoms, highways, rail and aviation to meet rising demand for renewal and resilience work in core regulated markets.

Chief Executive Officer Andrew Findlay said: “We remain focused on complementing our organic growth opportunities with strategic acquisitions that enhance our capabilities and expand our addressable markets. This is underpinned by our recently launched business-wide transformative programme.”

Comments are closed