Landsec to pump £2bn into new house building drive

Landsec to pump £2bn into new house building drive

Developer Landsec is ramping up plans to establish a £2bn residential platform by 2030 as it shifts investment focus away from London offices and into large-scale housing schemes in the capital and Manchester.

The property giant is preparing to start on site from late 2026 across a trio of major residential-led projects that will deliver more than 6,000 homes.

At Finchley Road in north London, enabling works and demolition have already been completed for the first phase of a consented 1,800-home scheme. Detailed planning is in place for the first 600 homes, with a variation decision expected later this year.

In Manchester, Landsec has restructured its agreement with JV partners at the Mayfield site to unlock the potential for around 1,700 homes. A decision on detailed plans for the first 879 units is also expected in the second half of 2025.

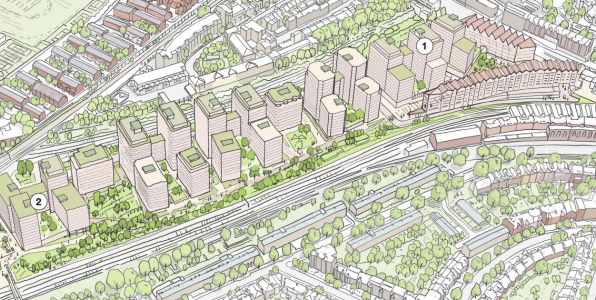

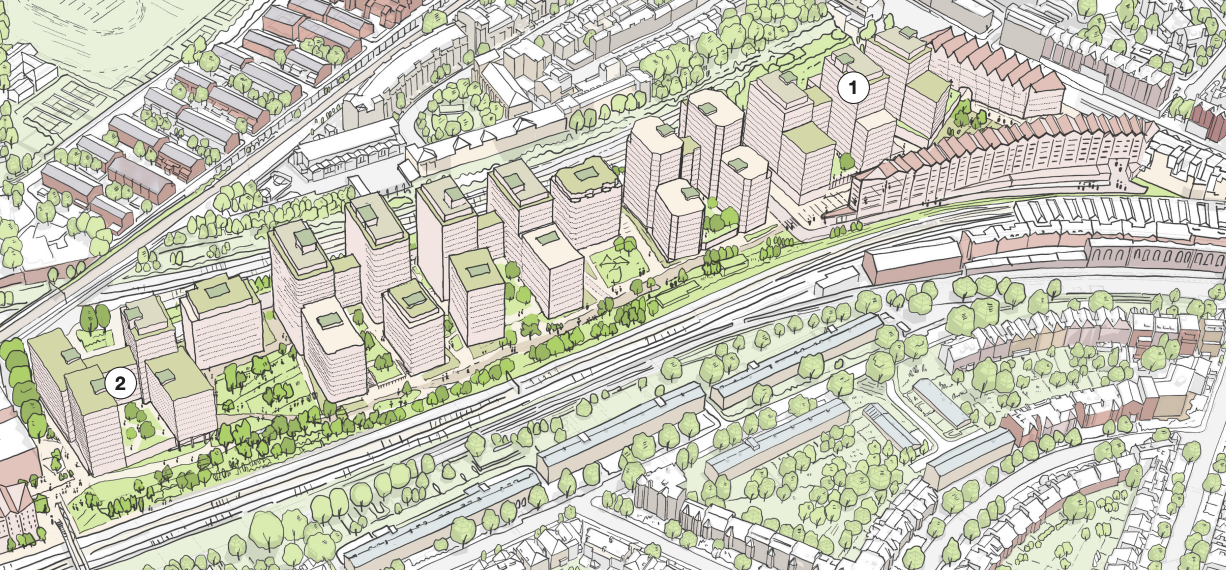

The third key site is in Lewisham, south-east London, where a masterplan covering up to 2,800 homes – including student and co-living accommodation – is awaiting planning sign-off.

Landsec aims to recycle £3bn of capital out of offices and non-core assets to fund the residential push and a further £1bn of retail acquisitions.

Chief executive Mark Allan said: “Our capital allocation decisions from here are about ensuring that the growth outlook for our portfolio in 3-5 years’ time is as positive as it is for our current portfolio today.

“That is why we have set out a clear plan to increase investment in major retail by a further £1bn and establish a £2bn+ residential platform by 2030, to be funded by rotating £3bn of capital out of offices.”

The firm expects gross yields on housing schemes of around 6.5%, with net yields of 4.8–5.5%.

Meanwhile, Landsec has committed £600m to top-tier retail assets including Liverpool ONE and Bluewater over the past year and is targeting another £1bn of investment in prime shopping destinations where yields are currently hitting 7–8%.

Comments are closed