How AI Can Support The Back Office In Any Construction Business – Part 1

How AI Can Support The Back Office In Any Construction Business – Part 1

The post How AI Can Support The Back Office In Any Construction Business – Part 1 appeared first on UK Construction Blog.

Written by Sandra Kirsch from Craeftig

Artificial Intelligence (AI) has become the go to for anyone looking to achieve advancement and simplification in business processes specifically in back-office operations such as project management, purchasing and accounting in any kind of business may they be small or medium to large businesses/enterprise. Medium to large Enterprises can easily consume such new technology as application suppliers are ploughing the field ahead. Whilst small to midsize businesses such as plumbers, heating engineers, electricians, carpenters, builders, handyman, landscapers and many more, struggle to make sense of such and how to consume/use this new technology as application partners are sitting on the fence. This is where external application and software partners need to step away from �business as usual� but think outside the box to enhance their existing solutions to include automation through artificial intelligence, reducing manual processes that negatively impact business profitability and management even in small construction businesses.

AI can challenge and provide greater ability to manage projects/jobs, schedule staff, project/ job specific purchasing, cost management, customer financials and finally bookkeeping.

Let’s discuss in detail each of these areas in this 2-part article. You will see enablers to support any construction business from contractor, one man band businesses to medium size construction businesses.

This part of the article will focus on the quoting and estimates, customer maintenance and customer financials.

Quotes and Estimates

The quoting and estimation of your construction business has huge potential for automation using new technology underlying Artificial Intelligence. The usage of previous pricing information, customer behaviour and trends will allow you to easily build quotes /estimates that provide insight and personalisation to win more business.

One dimension of pricing is finding the current prices for products. Whilst estimating or quoting robots can detect easily the products required for the customer and find current market pricing at building stores/merchants, therefore reducing costs to customers by providing fully up to date pricing. Saving you additional time to research where to buy products.

The second dimension in estimating and quoting is to calculate product quantities and time required for the install i.e. installing electrics throughout a residential new build. The electrician is reliant to manual calculate the requirements for switches, cabling, time for install (first fix and second fix). When using a solution that has embedded artificial intelligence things such as images can be used, to evaluate historical data and architectural drawings. This information can be used estimate the products required as well as the man hours required to perform the install. This enabler can greatly reduce the hours spend in an office to evaluate all the information provided and therefore allow you to focus on the finer details and adjustment required to provide a more personalised quote/estimate to your potential and existing customers.

Beyond pricing we have the option to include robots to interact with customer on your behalf. As simple as a follow up robot that will automate checking in with customer on the quote or estimate will reduce the number of man hours required for your business but still providing the personal touch.

So, to sum up the Benefits for you to look out for in a solution/app that includes abilities such as mentioned above:

- Reduction in hours spend in the office;

- spend more time with your current and future customers ;

- improve accuracy in your estimates that will win you business;

- guessing game is greatly reduced.

Maintenance

Regular maintenance i.e. annual services such as Plumber or Heating Engineers servicing heating systems have become a target for optimisation. Using insight about installed products such as boilers or heat pumps in customers; may it be residential or commercial, such as historical data and failure information to predict maintenance instead of the 12 month or any other regular service interval. Predictive maintenance will align better with customers expectations and reduce the impact of repairs required and therefore save your customers long-term costs as well as reducing the impact on your business from emergency call outs.

Let’s take the example of on oil based residential heating system, whilst it has been installed over 20 years ago and annual service was carried out. Often a breakdown of the oil pump is unavoidable over the duration of ownership and its usually during times where its critically needed such as a cold spell bringing Murphy’s Law into play. If the installed product has had similar breakdowns with other owners of the same product, a solution including predictive maintenance can provide early warning that the oil pump failure is imminent and therefore a replacement can be scheduled as part of the service avoiding the additional call out charges for customers.

Whilst looking at more modern systems installed in your customers homes; these provide insight through sensors. The sensor monitors the performance of the heating solution over its lifetime and outliers produced by the sensors can trigger maintenance as and when required. Thus, reducing the need for scheduled maintenance, again it’s the predictive capability managed over the sensor information that can trigger these events to the engineer’s application to inform the customer to book a service. This will avoid more costly breakdowns using the right solution installed in their home, such as smart home capabilities.

The benefits of such a solution include:

- Emergency callouts are reduced;

- less disruptions to scheduled customer work in your diary;

- better Customers service;

Customer Financials

Let’s focus on some of the financial processes with your customers where it can be easy to apply this technology to simplify and reduce labour and time effort.

There are several approaches within the customer financials that can be enabled using artificial intelligence. These will serve any trades business to simplify their processes and allow faster decision making. Let’s talk about the following areas of optimisation in customer financials:

- Customer Invoicing

- Customer Payments

- Customer Payment Options

- Customer Reminders.

Let’s focus on Customer Invoicing where we find the usage of AI helpful. It can validate the correctness and completeness of invoices if they are based on either on time & material or fixed price (quote-based) customer invoicing. The sense check applied by human is a behaviour pattern; this in turn can be trained into models that apply these automatically to your invoicing. So gone are issues such as time not allocated, consumables or even specific tool charges forgotten.

In the instance of Customer Payments, we can train models to learn your customers behaviour and apply such to your invoicing process. Something as simple as a customer always paying late, could be the thing in the past. We can apply a simple technique to late payers to reduce the number of days till the invoice is due. Therefore, getting the payment into your company just on time.

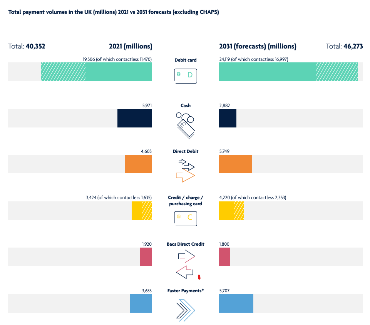

We also need to consider payments and processing of such. Each customer has a preferred method of payment they would like to use. It is also worth to acknowledge the future of payment processing in the UK, showing the future of payments is towards mobile wallets and card payments.

Any solution providing payment services should consider their customers behaviour and provide them with options specifically tailored to their needs and pre-proposed such. This will provide a seamless interaction for the customer with the business.

As for manual reminders for overdue customer payments; these could be a thing in the past. Again, by using the customers behaviour, we can establish when invoices become overdue and automate reminders to ensure payments are made.

Benefits using AI for your customer financials can be:

- reducing the time spend chasing customer payments;

- early actions to ensure your cashflow is optimised;

- minimizing human errors;

- increase in profitability of your contracting / trades business.

In the second part of the article, we will focus on Job/ Project management, Scheduling and Bookkeeping.

Comments are closed